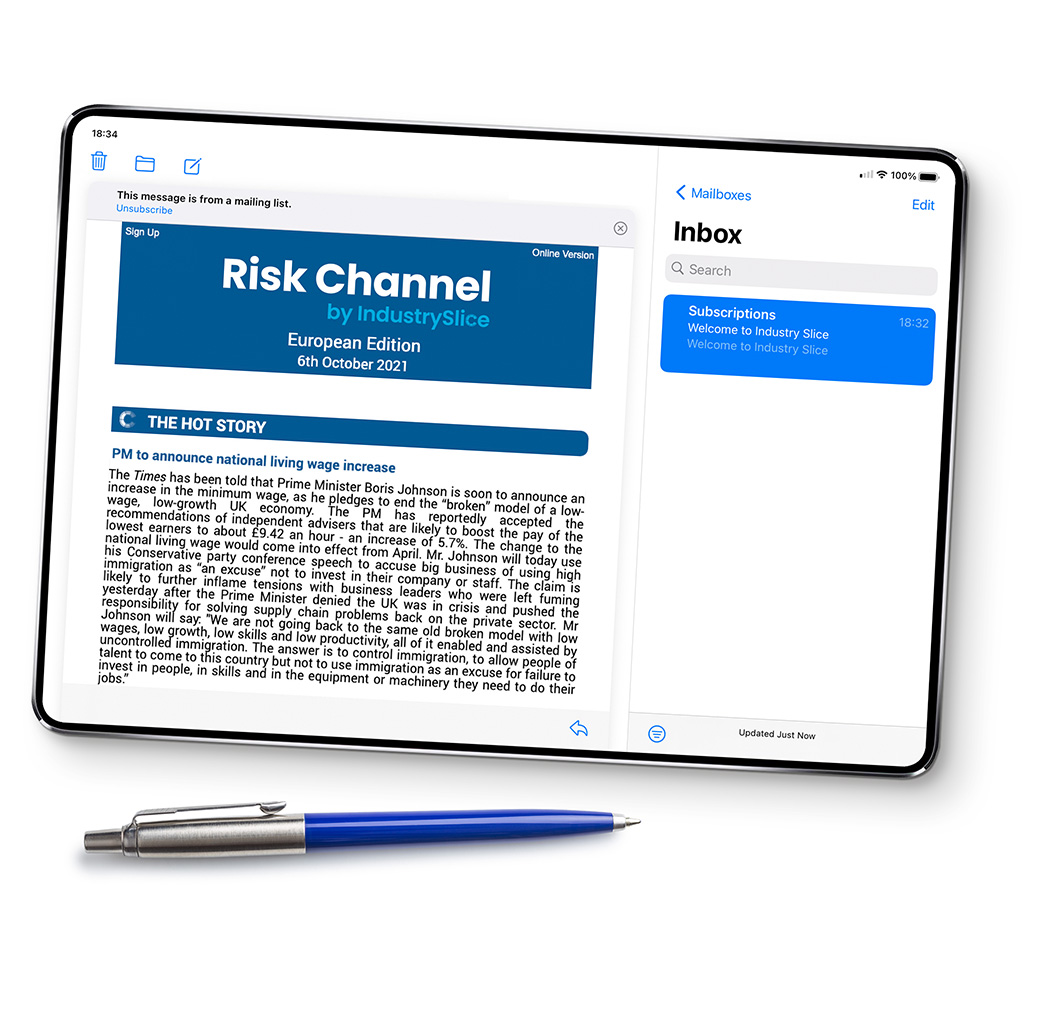

You’re all signed up for Risk Channel

Thank you for your interest in our service.

Watch out for a confirmation email from our subscriptions team. Once you have confirmed you will join the worldwide community of over 14,000 subscribers who are receiving daily Risk intelligence to lead, innovate and grow.

Note: Due to the nature of this message you may find this in your "promotions" or "spam" folders, please check there. If nothing arrives within a few minutes let us know. If you do not receive this email we will be happy to help get you set up.

Adding the email address [email protected], will help to ensure all newsletters arrive directly to your inbox.

Recent Editions

Risk Channel

North America

The Public Company Accounting Oversight Board (PCAOB) is currently deliberating whether to publicly disclose the names of companies that have received deficient audits as part of its inspection reports, responding to longstanding requests from investors. PCAOB Chair Erica Williams confirmed the ongoing evaluation of this issue, which has been under consideration for years and reflects the complexity and longstanding nature of the debate. Historically, the PCAOB has stated, in memos from 2004 and 2012, that the Sarbanes-Oxley Act of 2002, which established the PCAOB, limits its authority to release certain information from its inspection processes. However, investors have continuously argued that the act provides the PCAOB with the discretion to decide what details should be included in inspection reports, advocating for greater transparency in the auditing process. The discussion around disclosing audit deficiencies is part of a broader push by investors to understand which audits specifically failed to meet standards, which they believe could significantly impact investment decisions and market trust. The PCAOB's Investor Advisory Group has even recommended reversing the board’s policy to enhance transparency about the audits that are inspected. Meanwhile, stakeholders such as the Center for Audit Quality and the U.S. Chamber of Commerce have expressed concerns about the potential negative impacts on companies and the market, citing the risks of misinterpretation and unnecessary harm to the companies involved.

Full Issue

Risk Channel

UK/Europe

The Financial Reporting Council (FRC) has fined PwC and EY millions of pounds for their audits of London Capital & Finance (LCF), a minibonds firm which took money from almost 12,000 investors before collapsing in 2019. PwC agreed to a £4.9m settlement, discounted from £7m, tied to failures over its audit of LCF’s 2016 financial statements. PwC auditor Jessica Miller was also given a £105,000 sanction. PwC resigned as LCF’s auditor in October 2017. The regulator criticised the firm for an adequate understanding of LCF’s business and internal controls along with insufficient professional scepticism. EY, which audited LCF’s final 2017 accounts, agreed to a £4.4m penalty, discounted from £7m, while auditor Neil Parker was fined £47,250 – the same failures were noted by the FRC. A smaller firm, Oliver Clive & Co (OCC), which was responsible for auditing LCF’s 2015 statements, was fined £42,000 and auditor Emma Benjamin told to pay £14,000. Jamie Symington, the FRC’s deputy executive counsel, said: “These breaches are made considerably more serious by the fact that all of the auditors knew they were auditing an expanding business which was engaged in selling unregulated financial products to retail investors, and that potential investors might place reliance on the clean audit opinions.”

Full Issue